If you structure your business as a partnership or S Corporation, there is one form you need to learn like the back of your hand. And, you need to make sure your partners know the form, too. That oh-so-important form is Schedule K-1. So, what is Schedule K, and what does it do?

What is Schedule K-1?

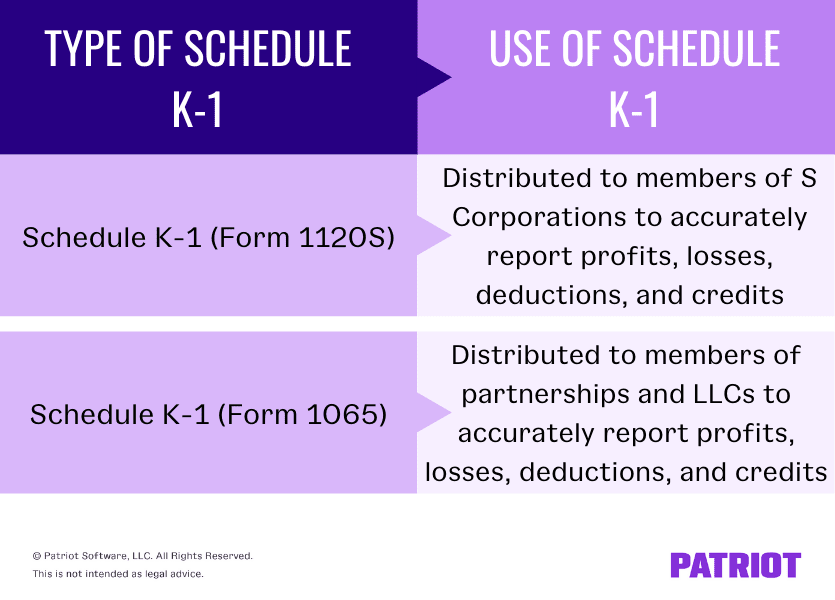

IRS Schedule K, also known as Schedule K-1, has two distinct forms for businesses:

- Schedule K-1 (Form 1120S), Shareholder’s Share of Income, Deductions, Credits, etc.

- Schedule K-1 (Form 1065), Partner’s Share of Income, Deduction, Credits, etc.

The company’s business structure determines which form the business prepares and distributes to owners, partners, or members.

Taxpayers typically file Schedule K-1 with their individual tax returns. Schedule K-1 reports earnings, losses, and dividends for the tax year. Owners, partners, or members use the information on the K-1 form to report the profits, losses, tax deductions, or tax credits on their personal income tax returns.

With Schedule K, businesses must track each partner’s or stakeholder’s ownership or stake in the business. The percentage of ownership determines the amount you report on each K-1 tax form.

Form 1120S vs. Form 1065

What is Form 1120S, and what is Form 1065?

Form 1120S, U.S. Income Tax Return for an S Corporation, is an IRS tax form that S corporations use to report their business’s annual financial information.

Form 1065, U.S. Return of Partnership Income, is an IRS tax form that partnerships (or LLCs filing as partnerships) use to report their business’s annual financial information.

Who needs to file Schedule K?

Again, Schedule K-1 typically pairs with Form 1120S or IRS Form 1065. However, individuals may need to file Schedule K, too. Entities with individuals who must file Schedule K-1 also include:

- Estate beneficiaries

- Beneficiaries of trusts

Businesses that do not pass through taxes to the owners’ individual tax returns (e.g., C corporations) do not file Schedule K-1. And, not all pass-through businesses file Schedule K-1.

What is a pass-through business?

To understand why individuals file IRS Schedule K-1 and not businesses, you need to understand pass-through taxation. When a business has pass-through taxation, the taxes skip over (or pass through) the business and to another entity. So, the business does not pay the taxes directly.

Instead, another entity (typically the business owner or customer) pays the taxes. The business income is only taxed once with pass-through taxation. Business owners pay the tax on their Form 1040 at their personal tax rate rather than a business tax rate.

Pass-through tax entities include:

- Sole proprietorships

- S corporations

- Partnerships

- LLCs

Take note that sole proprietorships are pass-through entities that do not file Schedule K.

| Need help deciding on the right accounting software for you? Download our FREE guide about 10 Things to Consider When Choosing Accounting Software before you take the plunge. |

How to file Schedule K-1 based on business type

Again, the three business entities that must file a Schedule K-1 include S corporations, partnerships, and LLCs filing as partnerships.

S corporations

Business owners must file Form 1120S each year to report their income. Each shareholder in an S corporation must receive a Schedule K-1 Form 1120S. Shareholders use the information on Schedule K to report the same information on their individual returns.

The K-1 tax form for S corporations must show how the business distributes income to the shareholder based on the shareholder’s stakes in the business.

The main sections of the Schedule K-1, Form 1120S are:

- Information about the corporation

- Information about the shareholder

- Shareholder’s share of income, deductions, etc.

For example, say you have a 25% stake in an S Corp. In one tax year, the business has a net profit of $100,000. So, your K-1 form shows $25,000 ($100,000 X 25%) in funds from the S corporation for the year.

Partnerships

With partnerships, each partner must report their share of income, losses, deductions, and credits as filed on Form 1065. Based on informational Form 1065, the business must distribute Schedule K to each partner to show their individual share.

All Schedule K-1s should be filed with the business’s tax return. And, each partner must file a copy with their Form 1040 when filing their taxes. Like with S corporations, the business determines the amount listed on Schedule K-1 based on the number of shares a partner has.

IRS Schedule K-1 Form 1065 has three main sections:

- Information about the partnership

- Information about the partner

- Partner’s share of income, deductions, etc.

For example, a business partnership has three partners. One partner owns a 50% stake in the company, while the other two each have a 25% stake. In one tax year, the business earns a profit of $100,000. The partner with a 50% stake reports $50,000 ($100,000 X 50%) while the other two each report $25,000 ($100,000 X 25%).

Many businesses have partners with an equal stake in the business. In that case, divide the profits equally between each business partner.

LLCs

If you have a limited liability company (LLC) filing as a partnership, you must file Form 1065 and distribute Schedule K-1 to all members just as you would in a standard partnership. In LLCs, owners are the same as members.

LLCs do not restrict members, so multi-member LLCs can include individuals, other LLCs, corporations, and partnerships. Every single member of the LLC must receive a Schedule K-1 no matter their structure.

Most LLCs with multiple members receive the same tax treatment as partnerships. If you have an LLC with partners or members, you may file to be taxed as a corporation. LLCs that do not file to be taxed as a corporation default to being taxed as a partnership.

The LLC itself does not send the K-1 tax form to the IRS.

When is Schedule K-1 due?

Individuals must file their tax returns by April 15 of each year for the prior tax year. File Schedule K-1 with your Form 1040. So, Schedule K-1 is due to the IRS no later than April 15.

Because Schedule K is due by April 15 each year, businesses must distribute the form to applicable individuals no later than March 15. Why March 15? Well, Forms 1065 and 1120S are due by March 15 each year. Without Forms 1065 or 1120S, individuals cannot receive Schedule K-1.

Businesses may file a six-month extension for filing the 1065 tax form using Form 7004. But, the business must still provide a Schedule K-1 to all applicable individuals no later than March 15.