You may follow all the rules when it comes to running payroll for your small business employees, but what about your household workers?

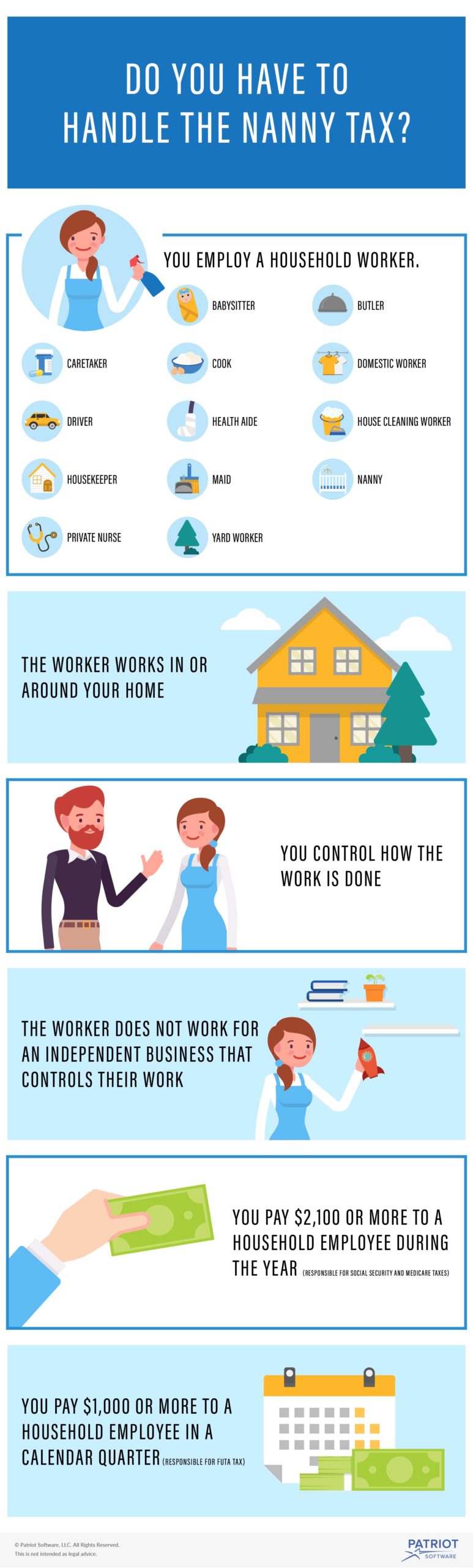

Regardless of whether you are an entrepreneur, employing a household worker makes you an employer. And as an employer, you are required to pay household employment taxes, otherwise known as the nanny tax.

Employing a nanny isn’t a spoonful of sugar if you don’t follow nanny tax rules. Read on to learn about the nanny tax, how to legally hire a household worker, and your depositing and filing responsibilities.

What is the nanny tax?

The nanny tax consists of Social Security, Medicare, and federal unemployment taxes. Individuals who hire household workers and pay them above the IRS thresholds are considered employers, making them responsible for paying and withholding the nanny tax. Federal, state, and local income taxes are not included in the nanny tax.

You must pay Social Security and Medicare (FICA) taxes for each qualifying household employee who earns above the IRS threshold of $2,100 in 2019. Pay federal unemployment (FUTA) tax for each employee you pay $1,000 or more to in a calendar quarter. You may be required to handle FICA, FUTA, or both.

So, who is a qualifying household employee? Household employees are workers who perform work in or around your home. Babysitters, caretakers, housekeepers, nannies, and yard workers are examples of qualifying household employees.

You do not have to withhold or pay Social Security, Medicare, or FUTA taxes if you pay wages to your spouse, child who is under the age of 21, or parent. You also do not have to pay Social Security or Medicare taxes if you hire someone who is under the age of 18.

There are restrictions to nanny tax exemptions you should know about. Consult IRS Publication 926 for more information on restrictions.

A closer look at nanny payroll taxes

Skipping your nanny tax responsibilities could open the door to IRS penalties. Instead, stay on top of your nanny payroll responsibilities.

If you meet the Social Security and Medicare requirements, you must withhold and pay the tax on the employee’s wages. FICA tax is an employee and employer tax, meaning you pay half and withhold the other half from the employee’s wages.

The Social Security tax rate is 6.2%. You must withhold 6.2% from the employee’s wages and pay a matching employer contribution of 6.2%. Continue withholding and paying the Social Security tax until the employee earns above the Social Security wage base.

Medicare tax is 1.45%. Withhold 1.45% from the employee’s earnings and pay a matching 1.45%. There is also an additional Medicare tax (employee only) of 0.9% if the employee earns above a certain threshold.

You can choose to pay both the employer and employee portions of FICA tax. If you do, you will pay a total of 15.3% for the employer and employee portions of Social Security and Medicare taxes.

You may also be responsible for paying federal unemployment tax. FUTA tax is an employer-only tax that is imposed on the first $7,000 of an employee’s earnings. FUTA tax is 6% of an employee’s earnings, but you may be eligible for a tax credit of up to 5.4%, which would reduce your FUTA tax rate to 0.6%.

If you are responsible for the nanny tax, you do not need to handle federal income tax withholding. Household workers must pay income tax on their own. However, you can choose to withhold income tax if your employee requests it.

Your state may require that you pay state unemployment tax. Contact your state to find out your state unemployment tax requirements.

Tax deduction

You might be able to claim a tax credit for child and dependent care expenses, which would reduce your tax liability. To qualify, you must meet IRS requirements, which are explained in Publication 503.

Nanny tax rules to follow when hiring

When you hire a household employee and handle the nanny tax, you need to verify the worker is eligible to work in the United States, apply for an EIN (Employer Identification Number), and set up payroll.

If you agree to withhold federal income tax, the employee must also complete Form W-4, Employee’s Withholding Allowance Certificate.

To verify the worker can legally work in the U.S., you and your household employee must complete Form I-9, Employment Eligibility Verification. If you are required to handle Social Security and Medicare taxes, ask the employee to show you their Social Security card, and record their number.

You also need an EIN. An EIN is similar to a Social Security number. Your EIN identifies you as a household employer so you can file nanny taxes.

Lastly, you must implement a payroll method to accurately withhold and pay payroll taxes. Be sure to withhold the employee portion of FICA tax, if applicable, before you give the employee their wages. Using payroll software can simplify tax calculations.

Filing and paying nanny taxes

You are responsible for depositing and reporting nanny taxes to the IRS. How you file and pay the nanny tax depends on whether or not you own a small business.

All household employers must complete Form W-2, Wage and Tax Statement. Distribute the W-2 form to your employee(s), the Social Security Administration, and (if applicable) state tax department.

Non-business owner

If you do not also own a small business, you have a few options for paying the nanny tax.

You can ask your employer to withhold more money for federal income tax from your wages to cover the nanny tax, make estimated tax payments throughout the year, or make one lump sum payment when you file your personal tax return.

Use Schedule H (Form 1040), Household Employment Taxes, to report wages subject to the nanny tax and your tax liability.

Business owner

If you own a small business, you can combine your household employee payroll tax payments with your business employees’ deposits. How often you deposit the nanny tax depends on your small business’s tax deposit schedule, which is based on a lookback period. You will either make monthly or semiweekly deposits.

You can also combine your reporting responsibilities. As a business owner, you must report FICA and federal income taxes on IRS Form 941, Employer’s Quarterly Federal Tax Return, or Form 944, Employer’s Annual Federal Tax Return. And, you must report FUTA tax on Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. If you are responsible for FICA and FUTA taxes for your household employees, include them on your forms.

You do not have to file Schedule H if you combine your business employees’ and household employees’ deposits and reports.

Recordkeeping

Be sure to keep payroll-related records for at least four years after your tax return or tax payment due date, whichever is later. Hang on to records like Schedule H or employer tax return forms (e.g., Form 941) and pay stubs.

Need help calculating your nanny tax liability? Patriot’s online payroll can help. Enter your household employee’s hours worked and pay rate, and we’ll calculate your FICA and FUTA tax amounts. Get your free trial today!

This is not intended as legal advice; for more information, please click here.