Small business owners are passionate, hardworking people. They are positive, resilient, and dedicated to creating a sustainable and profitable business. But, they are not accountants, so accounting for small business owners can be confusing.

You’re in charge of making sure your books are in order. But if you’re like most small business owners, your bookkeeping practices might be almost non-existent. If the only place you track your company’s spending and revenue is in your bank account, you need to get a handle on some accounting basics.

Accounting for small business owners

One unfortunate reason that small businesses struggle is from miscalculating expenses and taxes. Incorrect calculations can lead to some companies:

- spending money they do not have

- missing tax payments

- losing out on tax refunds

No matter how strong your products and services, accurate accounting basics can make or break your business. Try the following tips to deal with the ins and outs of bookkeeping.

Tip #1: Start with cash basis accounting

When it comes to the basics of accounting for small business owners, start with cash basis accounting. Cash basis accounting is simple – cash in, cash out.

In cash basis accounting, you do not record transactions until the money changes hands. You make a record each time you get paid for a sale. You also make a record each time you spend money. Record transactions on the day they happen, when they occur.

Tip #2: Know what to record

“Everything” may be too complicated an answer. But the more in-depth your records, the better. Keeping track of all incoming and outgoing payments is important.

Things you need to record as incoming funds include:

- The products or services you sell

- Who you sell the item to

- How much money you collect

- The date you receive the money

- How much sales tax you collect (if applicable)

Things you need to record as outgoing funds include:

- The taxes you pay

- Employee paychecks

- The operating expenses you pay (supplies, inventory, etc.)

- The overhead expenses you pay (rent, utilities, insurance, etc.)

It’s important to keep track of every dollar that goes in and out of your company for several reasons.

You might be able to claim small business tax deductions based on your income or your type of business structure. For example, you might deduct coffee with a potential partner. Or, you might deduct the health insurance you bought.

Also, some incoming money might not be revenue at all, like in the case of sales tax. By clumping all your cash into one account, it may be hard to separate sales tax payments from your income.

Along with incoming and outgoing funds, there may be other numbers you will want to track. For example, do you send invoices to customers? In that case, you will want to know how much is owed to you.

Tip #3: Record transactions in separate accounts

Some small businesses only use a spreadsheet or bank statement to log transactions. Rarely do those records show every expense, nor do they allow you (or the IRS) to visualize your net income.

You should record each transaction you make every day. Don’t worry – with the right bookkeeping software, it will not take as much time as you might think.

To record business transactions, place every amount you collect on a separate line. That way you know exactly how much money you earned and when you collected it.

Do the same thing for every amount you spend. You’ll want to record where you spent the money and which day you spent it.

Recording your transactions line-by-line helps you find the payments that qualify you for tax breaks. Line-by-line records also show how much of each payment you received goes to taxes.

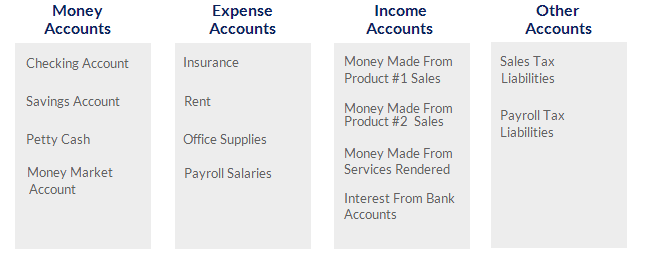

You may also want to break down the transactions further, using a chart of accounts. A chart of accounts gives you a complete list of every account in your books.

To use a chart of accounts, separate each transaction into a main account, such as as an asset. Then, connect each transaction to specific subaccount within the main account, such as a cash account.

For example, someone buys a product with $20 in cash. The cash is an asset, so you mark it in the asset account. Because it is cash, you mark it under the cash account, which lives within the asset account. The idea is to separate your transitions logically so you can easily make sense of your books.

Example chart of accounts:

Make sure you log specific data. Accurate bookkeeping is about understanding your business’s financial health and the amount of liquidity you have.

Is worrying about accounting basics distracting you from what you love the most about your business? Patriot’s online accounting software makes accounting simple, and you’ll save precious time. Try it for free today!