As a small business owner, you might not be an accounting wizard, but your math needs to add up. Sometimes, even the greatest mathematicians make mistakes. To discover and get to the root of errors in your double-entry accounting books, use a trial balance.

If you use accrual accounting to manage your books, your credits and debits need to be equal. Because there are so many types of accounts and incoming and outgoing money you need to keep track of, it’s easy to make mistakes. Using a trial balance can help prevent mistakes from harming your business. Find out what a trial balance is and how to use it.

What is trial balance?

A trial balance is an accounting report that lists your general ledger account balances in two columns: debits and credits. The report shows you whether your debits and credits equal one another.

If your debits and credits are unequal, you must find ways to balance the accounts. You could have unequal debits and credits as a result of incorrectly posting accounting entries, forgetting to record an account, or miscalculating.

Don’t panic if your debits don’t match your credits. The purpose of trial balance is to find errors and fix them so your accounting books are accurate. When you find the source of an issue and make changes to the account(s) or numbers, you are left with an adjusted trial balance.

You should prepare trial balance reports at the end of each reporting period. This ensures that your books are accurate and updated, which could save you from audits and penalties.

How to prepare a trial balance

Now that we’ve answered, what is the purpose of a trial balance, it’s important to learn how to create one.

To create a trial balance, you will need your general ledger information. You must take the accounts and dollar amounts from your accounting books and add them to your trial balance worksheet.

When preparing a trial balance, separate your debits and credits by account. You should have three columns: accounts, debits, and credits.

Once you set up the trial balance format, you will need to look at your general ledger entries. Take the information from your general ledger and enter it into your trial balance worksheet. You will list each account and the amount in the trial balance.

When you have entered all the information into your trial balance, you need to find the total for debits by adding up all the amounts in the debit column. Then, find the total for the credit account.

If the two numbers match, you have a balanced trial balance. If the two numbers are unequal, you have an unbalanced trial balance. In double-entry accounting, your debits must equal your credits. You will need to find out why the totals don’t equal and adjust your entries.

Trial balance examples

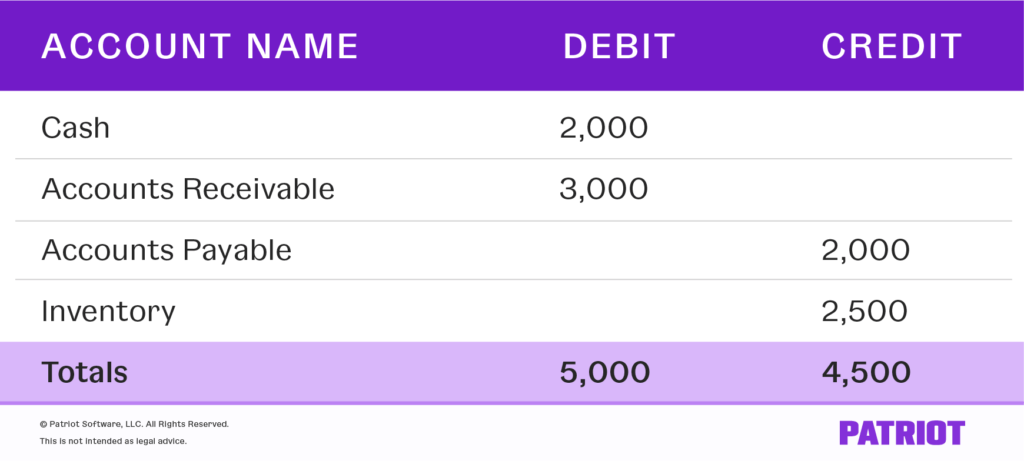

Take a look at examples to help you learn trial balance accounting. Here is how your worksheet should look for a trial balance:

Now, you need to learn how to read a trial balance. To determine whether your balances are equal, just look at the total values. As you can see, the debits equal the credits. This means you don’t need to adjust anything with your trial balance.

Sometimes, your debits and credits will be unequal. If there is a mistake, you will have an unbalanced trial balance:

There is a discrepancy of $500 between the debits and credits. You need to refer back to your general ledger to determine where the error is. Start by looking at your accounts receivable and inventory entries (you have three entries).

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 12/1/2017 | Accounts Receivable Inventory |

Sale to Customer | 1,000 | 500 |

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 12/7/2017 | Accounts Receivable Inventory |

Sale to Customer | 1,000 | 1,000 |

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 12/14/2017 | Accounts Receivable Inventory |

Sale to Customer | 1,000 | 1,000 |

The first entry, created on 12/1, is unbalanced. You debited $1,000 but only credited $500 worth of inventory. This is the $500 discrepancy. Now that you know where the error is, you can adjust the entry so it looks like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 12/1/2017 | Accounts Receivable Inventory |

Sale to Customer | 1,000 | 1,000 |

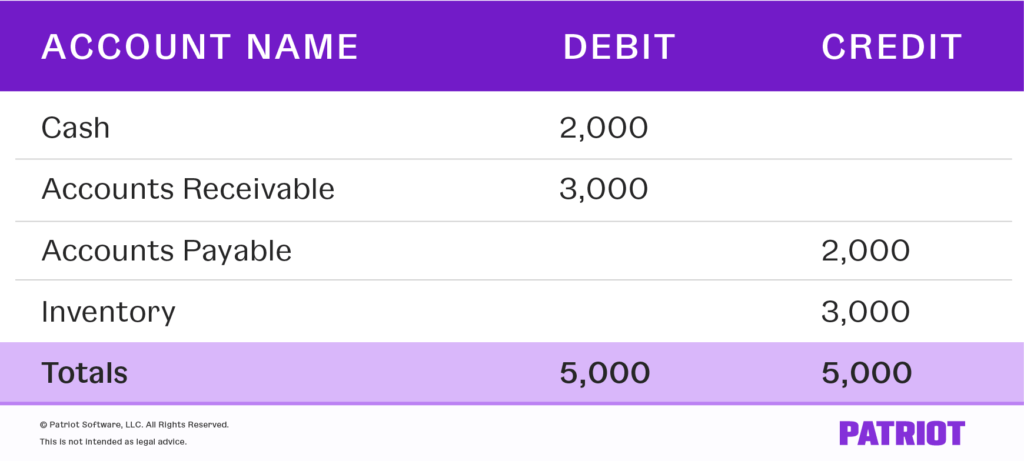

Next, you can update your trial balance with the new value. Now, your adjusted trial balance is correct. Your adjusted trial balance will look like this:

You have an adjusted trial balance … what now?

Aside from appeasing your accountants and auditors, an adjusted trial balance is essential to your business’s health. A trial balance verifies your accounting books are accurate, and an adjusted trial balance corrects errors in your books.

You probably already know the importance of accurate books. They keep your business legal and away from auditing trouble. You also need correct accounting books to create financial statements. Use financial statements to make decisions about your business, like where to cut business expenses and how to speed up cash flow.

There are three major financial statements used in business: income statement, balance sheet, and cash flow statement. You need to use information from your accounting books to prepare financial statements. If you don’t use a trial balance, you risk preparing financial statements with potentially inaccurate data.

Here’s how you can use your trial balance:

Preparing an income statement from a trial balance: An income statement summarizes your revenues and expenses. You need the information from your accurate accounting entries to create the statement.

Preparing a balance sheet from a trial balance: A balance sheet shows you your assets, liabilities, and owner’s equity. You must use your accounting books to create a balance sheet.

Preparing a cash flow statement from a trial balance: Typically, you create your cash flow statement using the information from your income statement and balance sheet.

Basically, your trial balance is an unrecognized hero necessary for decision-making. You need the trial balance to adjust your accounting books. You need to adjust accounting entries to prepare financial statements. And, you need financial statements to make decisions about your business, secure funding, and more.

| Craving even more information about financial statements? You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business, to learn more about the different types of financial statements for your business. |

Keeping accurate books and catching mistakes can be time-consuming. Instead, try Patriot Software’s online accounting for small business. Maintain accurate records and create financial statements. Try it for free today!

This is not intended as legal advice; for more information, please click here.