If you’re an employer, you likely know that withholding, contributing, and remitting employment taxes is essential to running legal and accurate payrolls. Before calculating how much to withhold and contribute, you need to know about the tax wage base.

Some taxes have a wage base while others do not. To avoid overwithholding and overpaying taxes, you must be mindful of which taxes have a wage base.

What is a taxable wage base?

A wage base, or threshold, is the maximum amount of an employee’s income that can be taxed in a calendar year. When an employee earns above a tax’s wage base, stop withholding or contributing that tax.

As an employer, you must withhold applicable taxes from an employee’s wages until they meet the threshold. If you withhold past the wage base, the employee is owed the overwithheld funds.

You must also pay taxes on employee wages. Contribute taxes until the employee earns more than the wage base. Once the employee earns above the wage base, stop paying taxes subject to that wage base.

If an employee’s annual income is below the wage base, continue withholding and contributing the tax throughout the year.

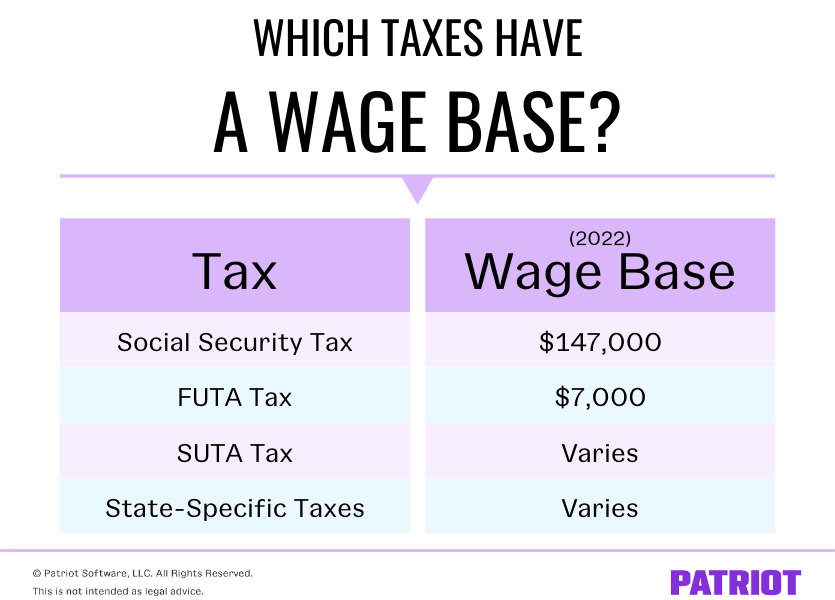

Which taxes have a wage base?

Not all taxes have a wage base.

Federal, state, and local income taxes do not have a wage base. And, Medicare tax does not have a wage base. Instead, there is an additional Medicare tax imposed on employees when they earn above a certain threshold.

These are the taxes with a wage base that you may have to withhold from employee wages:

- Social Security tax

- SUTA tax

- State-specific taxes

Here are the employer taxes with a wage base that you must contribute:

- Social Security tax

- FUTA tax

- SUTA tax

- State-specific taxes

Keep in mind that wage base amounts vary by tax. Read on to learn about each type of tax and its wage base.

Social Security tax

Social Security tax is both an employer and employee tax. You must withhold 6.2% from your employees’ wages and contribute a matching 6.2% until the employee earns above the wage base.

The Social Security wage base is subject to change annually.

For 2022, the wage base is $147,000, meaning the maximum contribution is $9,114 ($147,000 X 6.2%). When an employee earns above this threshold, stop withholding and paying the tax.

FUTA tax

The Federal Unemployment Tax Act (FUTA) tax is an employer-only tax that, along with state unemployment taxes, helps fund unemployment programs.

The FUTA tax rate is 6%. However, most employers receive a FUTA tax credit that reduces their rate. You can receive a tax credit up to 5.4%, reducing your FUTA tax rate to 0.6%.

The FUTA tax wage base is $7,000. You will pay your FUTA tax rate on the first $7,000 that you pay each employee, per year.

The maximum FUTA tax amount you can contribute per employee is $420 ($7,000 X 6%). If you qualify for the maximum tax credit of 5.4%, the most you will pay per employee is $42 ($7,000 X 0.6%).

SUTA tax

In addition to FUTA tax, you must pay state unemployment (SUTA) tax.

SUTA tax works similarly to FUTA tax. You must pay your state’s unemployment tax rate on each employee’s wages until they earn above the wage base.

Most states set a higher taxable wage base for SUTA than the $7,000 FUTA tax wage base. For example, Ohio’s taxable wage base for calendar years 2020 and beyond is $9,000.

Each state sets its own SUTA tax rate and wage base, so be sure to check with your state for more information. Factors like experience, prior unemployment claims, and your industry influence your SUTA rate. The wage base is standard across your state.

Generally, SUTA tax is an employer-only contribution. However, some states (Alaska, New Jersey, and Pennsylvania) require employees to pay SUTA tax, too. If your state requires employee SUTA contributions, withhold the tax from their wages.

State-specific taxes

There are also wage bases for state-specific taxes. Depending on your business’s location, you may need to withhold or pay additional taxes.

For example, Massachusetts requires employers to pay the employer medical assistance contribution (EMAC) tax. The EMAC tax contribution rate depends on how long you have been subject to the state’s unemployment insurance law.

Check with your state to learn about other taxable wage bases.

You have enough on your plate without memorizing taxable wage bases. Let Patriot’s online payroll software calculate your taxes for you! Run payroll using our simple, three-step process and take advantage of our free expert support. Get your free trial today!

This article has been updated from its original publication date of November 7, 2018.

This is not intended as legal advice; for more information, please click here.